The growing commercial opportunity in women’s sport has long been hard to quantify. As part of a collaboration with Women’s Sport Trust and England Hockey, Nielsen Sports has released data that shows, the scale of the market in the UK and importantly, the opportunities for sponsors and broadcasters.

For the first time, we can quantify the scale of interest in women’s sport – and it’s big. 59% of the UK population have an active interest in women’s sport – that’s a potential market of 24 million people. This is a massive and largely untapped opportunity for brands and broadcasters.

Today, over half (59%) of the UK population is interested in women’s sport – 40% of people would consider attending live women’s sport, 42% would watch more if it was accessible on free TV and over a third (37%) would watch more if it was accessible free online.

Over recent years, the huge success of women’s teams, athletes and events, has fuelled a revolution in women’s sport and the data is now telling that story.

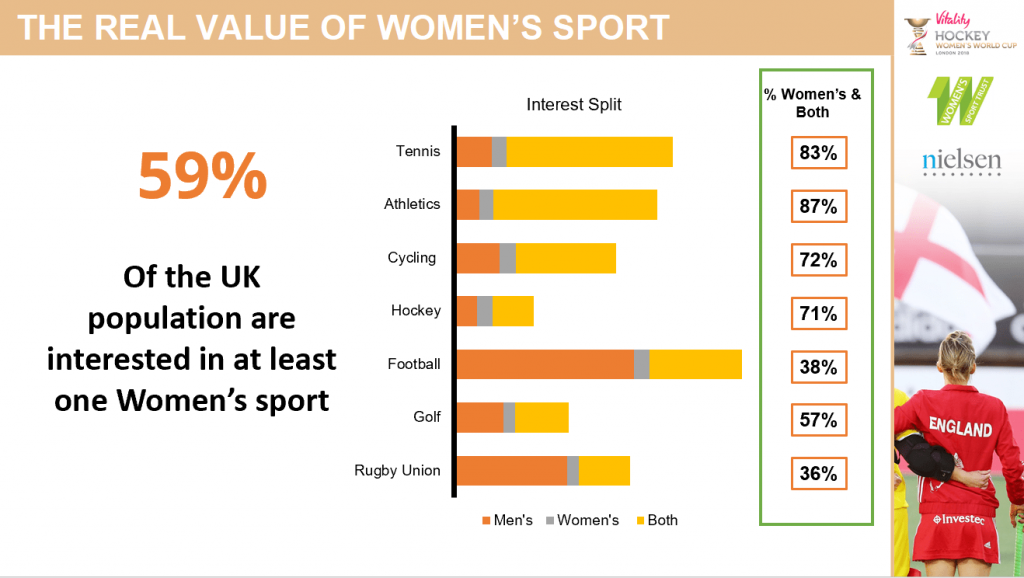

While athletics and tennis lead the way, there is also considerable interest in the major team sports:

- 87% of athletics fans in the UK are fans of women’s athletics

- 83% of tennis fans in the UK are fans of women’s tennis

- 72% of cycling fans in the UK are fans of women’s cycling

- 71% of hockey fans in the UK are fans of women’s hockey

- 57% of golf fans in the UK are fans of women’s golf

- 38% of football fans in the UK are fans of women’s football

- 36% of rugby union fans in the UK are fans of women’s rugby union

With large potential audiences interested in women’s sport and growing awareness of major sporting events there is plenty of opportunity for sports rights holders, broadcasters and brands to engage fans.

Women’s Sport Trust Joint Chief Executive, Jo Bostock commented “The leaders from major brands and broadcasters that we speak to have been telling us two main things. Firstly, that they are increasingly interested in women’s sport, but secondly, they need more data to help them make a case for investment.

The insights from Nielsen Sports clearly spell out the scope and scale of the opportunity. And you only have to look to the phenomenal example of the Vitality Hockey World Cup to see what’s possible when a top sport like Hockey puts on a great show and is backed by a committed brand like Vitality. We anticipate many more progressive brands moving from curious interest in women’s sport, to active investment in 2018-19.”

England Hockey Chief Executive, Sally Munday, added “We are very excited about beginning to realise the commercial opportunity of women’s hockey. Buoyed by the tremendous success of the national team, the Vitality Hockey Women’s World Cup has delivered sell-out crowds, significant media interest and a suite of consumer brands aligning with the sport. This provides the perfect platform to launch the FIH Pro League in 2019, a global, annual tournament which will be game-changing for our sport.”

Lynsey Douglas, Global Leader for Women’s Sport at Nielsen Sports said: “The commercial opportunity in women’s sport is growing at pace. Audiences are up and there is an increasing interest among the general population in the UK, across a number of sports. All the indicators point to it being a very good time to invest in women’s sport.”

The research highlights the positive values that fans associate with women’s sport – including ‘competitive’, ‘inspiring’, ‘progressive’ and ‘relatable’, which indicates the potential reputational value of brand associations. The data also sheds light on a youthful audience profile with an even split between females (51%) and males (49%) .

The UK data is being shared today in partnership with Women’s Sport Trust and England Hockey. A global Nielsen study is set to launch this summer, which will provide essential insight for commercial investment in women’s sport.

Women’s Sport Trust, Nielsen Sports and England Hockey are working together to provide evidence of the real value of women’s sport.

Download the insight below.